What Is Subject To Sales Tax In Tennessee . do you need to collect and remit sales tax in tennessee? If you have nexus in tennessee, the next step is to determine whether the products or. Sales tax in tennessee applies to most retail sales, as well as leasing or renting tangible personal property and selling certain taxable services, amusements, software, and digital products. penalties for failing to pay tennessee sales tax can include fines of up to 25% of the taxes owed as well as. tennessee has a statewide sales tax rate of 7%, which has been in place since 1947. tennessee nexus requirements.22 1. which sales are subject to tennessee sales tax? the sales tax is tennessee’s principal source of state tax revenue accounting for approximately 60% of all tax collections. Municipal governments in tennessee are.

from printableranchergirllj.z22.web.core.windows.net

penalties for failing to pay tennessee sales tax can include fines of up to 25% of the taxes owed as well as. tennessee has a statewide sales tax rate of 7%, which has been in place since 1947. Municipal governments in tennessee are. If you have nexus in tennessee, the next step is to determine whether the products or. do you need to collect and remit sales tax in tennessee? which sales are subject to tennessee sales tax? the sales tax is tennessee’s principal source of state tax revenue accounting for approximately 60% of all tax collections. tennessee nexus requirements.22 1. Sales tax in tennessee applies to most retail sales, as well as leasing or renting tangible personal property and selling certain taxable services, amusements, software, and digital products.

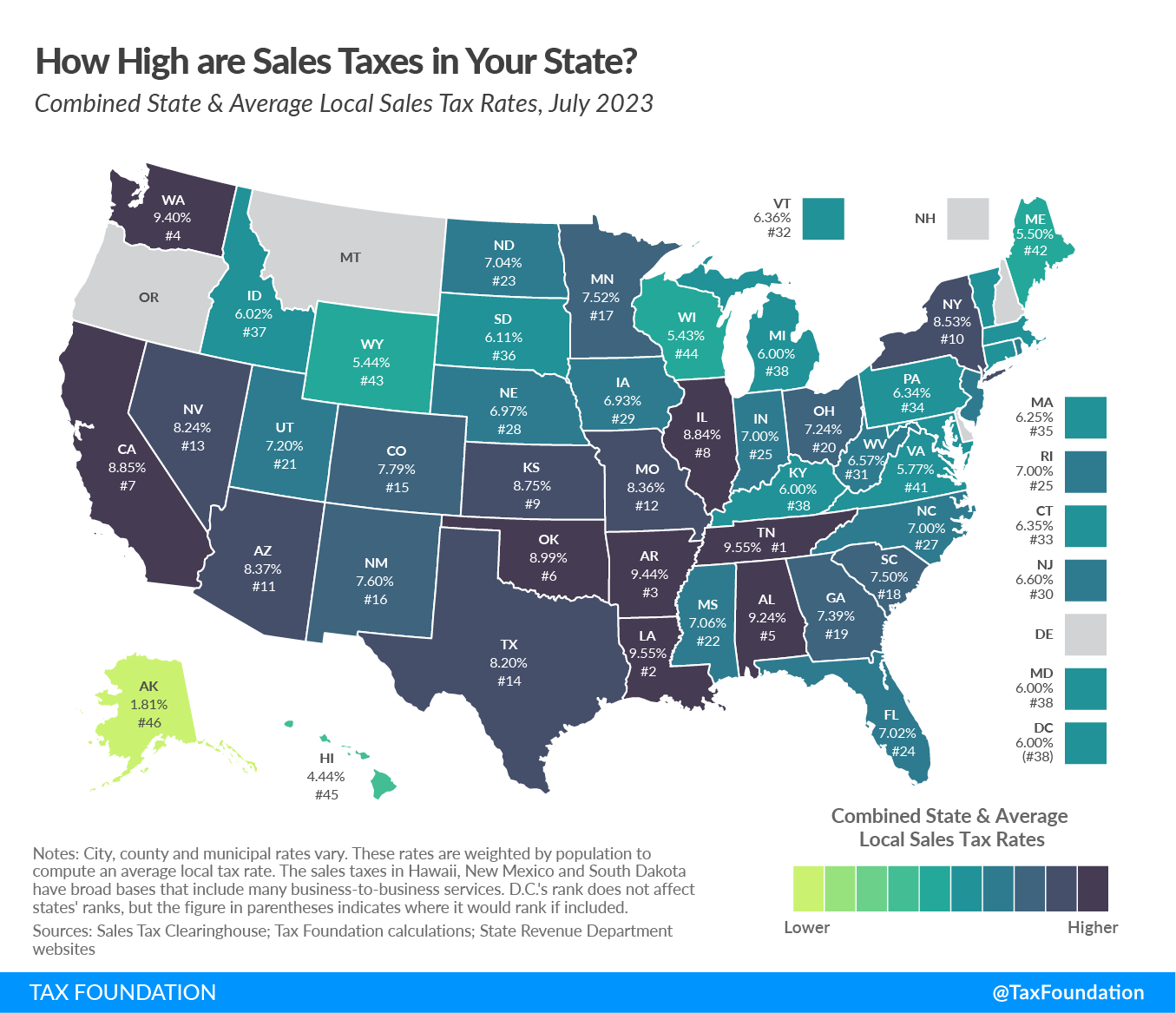

State Sales Tax Rate 2023

What Is Subject To Sales Tax In Tennessee tennessee has a statewide sales tax rate of 7%, which has been in place since 1947. tennessee nexus requirements.22 1. Sales tax in tennessee applies to most retail sales, as well as leasing or renting tangible personal property and selling certain taxable services, amusements, software, and digital products. tennessee has a statewide sales tax rate of 7%, which has been in place since 1947. the sales tax is tennessee’s principal source of state tax revenue accounting for approximately 60% of all tax collections. Municipal governments in tennessee are. If you have nexus in tennessee, the next step is to determine whether the products or. do you need to collect and remit sales tax in tennessee? which sales are subject to tennessee sales tax? penalties for failing to pay tennessee sales tax can include fines of up to 25% of the taxes owed as well as.

From www.youtube.com

Franchise & Excise Tax TN Investco Entities YouTube What Is Subject To Sales Tax In Tennessee which sales are subject to tennessee sales tax? tennessee nexus requirements.22 1. tennessee has a statewide sales tax rate of 7%, which has been in place since 1947. Municipal governments in tennessee are. do you need to collect and remit sales tax in tennessee? If you have nexus in tennessee, the next step is to determine. What Is Subject To Sales Tax In Tennessee.

From www.youtube.com

Using the Tennessee Sales Tax Resale Certificate YouTube What Is Subject To Sales Tax In Tennessee which sales are subject to tennessee sales tax? tennessee nexus requirements.22 1. If you have nexus in tennessee, the next step is to determine whether the products or. Municipal governments in tennessee are. do you need to collect and remit sales tax in tennessee? Sales tax in tennessee applies to most retail sales, as well as leasing. What Is Subject To Sales Tax In Tennessee.

From www.dochub.com

Sales tax tennessee 2022 Fill out & sign online DocHub What Is Subject To Sales Tax In Tennessee tennessee nexus requirements.22 1. If you have nexus in tennessee, the next step is to determine whether the products or. which sales are subject to tennessee sales tax? Sales tax in tennessee applies to most retail sales, as well as leasing or renting tangible personal property and selling certain taxable services, amusements, software, and digital products. Municipal governments. What Is Subject To Sales Tax In Tennessee.

From webinarcare.com

How to Get Tennessee Sales Tax Permit A Comprehensive Guide What Is Subject To Sales Tax In Tennessee Sales tax in tennessee applies to most retail sales, as well as leasing or renting tangible personal property and selling certain taxable services, amusements, software, and digital products. If you have nexus in tennessee, the next step is to determine whether the products or. tennessee has a statewide sales tax rate of 7%, which has been in place since. What Is Subject To Sales Tax In Tennessee.

From dxogyttcy.blob.core.windows.net

Property Taxes In Beverly Ma at Anthony Livingston blog What Is Subject To Sales Tax In Tennessee which sales are subject to tennessee sales tax? Sales tax in tennessee applies to most retail sales, as well as leasing or renting tangible personal property and selling certain taxable services, amusements, software, and digital products. the sales tax is tennessee’s principal source of state tax revenue accounting for approximately 60% of all tax collections. tennessee has. What Is Subject To Sales Tax In Tennessee.

From www.pinterest.com

Chart 2 Tennessee Tax Burden by Type of Tax FY 1950 to 2015.JPG Types What Is Subject To Sales Tax In Tennessee If you have nexus in tennessee, the next step is to determine whether the products or. Municipal governments in tennessee are. Sales tax in tennessee applies to most retail sales, as well as leasing or renting tangible personal property and selling certain taxable services, amusements, software, and digital products. tennessee nexus requirements.22 1. do you need to collect. What Is Subject To Sales Tax In Tennessee.

From www.dochub.com

Tennessee sales tax exemption certificate form Fill out & sign online What Is Subject To Sales Tax In Tennessee which sales are subject to tennessee sales tax? If you have nexus in tennessee, the next step is to determine whether the products or. do you need to collect and remit sales tax in tennessee? tennessee nexus requirements.22 1. Sales tax in tennessee applies to most retail sales, as well as leasing or renting tangible personal property. What Is Subject To Sales Tax In Tennessee.

From icma.org

Tennessee Department of Revenue Application for Registration Sales and What Is Subject To Sales Tax In Tennessee which sales are subject to tennessee sales tax? Municipal governments in tennessee are. tennessee nexus requirements.22 1. do you need to collect and remit sales tax in tennessee? penalties for failing to pay tennessee sales tax can include fines of up to 25% of the taxes owed as well as. Sales tax in tennessee applies to. What Is Subject To Sales Tax In Tennessee.

From www.formsbank.com

Form RvF1300701 Tennessee Sales And Use Tax Blanket Certificate Of What Is Subject To Sales Tax In Tennessee tennessee nexus requirements.22 1. Municipal governments in tennessee are. tennessee has a statewide sales tax rate of 7%, which has been in place since 1947. do you need to collect and remit sales tax in tennessee? which sales are subject to tennessee sales tax? penalties for failing to pay tennessee sales tax can include fines. What Is Subject To Sales Tax In Tennessee.

From www.besttaxserviceca.com

Who is subject to Tennessee business tax? Best Tax Service What Is Subject To Sales Tax In Tennessee tennessee nexus requirements.22 1. do you need to collect and remit sales tax in tennessee? Municipal governments in tennessee are. tennessee has a statewide sales tax rate of 7%, which has been in place since 1947. If you have nexus in tennessee, the next step is to determine whether the products or. which sales are subject. What Is Subject To Sales Tax In Tennessee.

From templates.esad.edu.br

Printable Sales Tax Chart What Is Subject To Sales Tax In Tennessee Sales tax in tennessee applies to most retail sales, as well as leasing or renting tangible personal property and selling certain taxable services, amusements, software, and digital products. Municipal governments in tennessee are. penalties for failing to pay tennessee sales tax can include fines of up to 25% of the taxes owed as well as. the sales tax. What Is Subject To Sales Tax In Tennessee.

From jacksontn.com

Jackson, Tennessee Tennessee Sales Tax Holiday What Is Subject To Sales Tax In Tennessee which sales are subject to tennessee sales tax? tennessee has a statewide sales tax rate of 7%, which has been in place since 1947. the sales tax is tennessee’s principal source of state tax revenue accounting for approximately 60% of all tax collections. Municipal governments in tennessee are. tennessee nexus requirements.22 1. do you need. What Is Subject To Sales Tax In Tennessee.

From www.signnow.com

Blank Sales Tax Form Tennessee Fill Out and Sign Printable PDF What Is Subject To Sales Tax In Tennessee the sales tax is tennessee’s principal source of state tax revenue accounting for approximately 60% of all tax collections. tennessee nexus requirements.22 1. Municipal governments in tennessee are. penalties for failing to pay tennessee sales tax can include fines of up to 25% of the taxes owed as well as. tennessee has a statewide sales tax. What Is Subject To Sales Tax In Tennessee.

From www.scribd.com

Tn Department of Revenue sales and use tax rules.pdf Use Tax Sales What Is Subject To Sales Tax In Tennessee If you have nexus in tennessee, the next step is to determine whether the products or. which sales are subject to tennessee sales tax? tennessee nexus requirements.22 1. the sales tax is tennessee’s principal source of state tax revenue accounting for approximately 60% of all tax collections. do you need to collect and remit sales tax. What Is Subject To Sales Tax In Tennessee.

From www.youtube.com

How the Sales Tax Works in Tennessee YouTube What Is Subject To Sales Tax In Tennessee tennessee has a statewide sales tax rate of 7%, which has been in place since 1947. the sales tax is tennessee’s principal source of state tax revenue accounting for approximately 60% of all tax collections. which sales are subject to tennessee sales tax? tennessee nexus requirements.22 1. Municipal governments in tennessee are. penalties for failing. What Is Subject To Sales Tax In Tennessee.

From www.yumpu.com

Tennessee Sales Tax Exemption Certificate Berea College What Is Subject To Sales Tax In Tennessee the sales tax is tennessee’s principal source of state tax revenue accounting for approximately 60% of all tax collections. tennessee nexus requirements.22 1. Sales tax in tennessee applies to most retail sales, as well as leasing or renting tangible personal property and selling certain taxable services, amusements, software, and digital products. If you have nexus in tennessee, the. What Is Subject To Sales Tax In Tennessee.

From www.formsbank.com

Tennessee Sales Or Use Tax Certificate Of Exemption Tennessee What Is Subject To Sales Tax In Tennessee Sales tax in tennessee applies to most retail sales, as well as leasing or renting tangible personal property and selling certain taxable services, amusements, software, and digital products. tennessee nexus requirements.22 1. If you have nexus in tennessee, the next step is to determine whether the products or. which sales are subject to tennessee sales tax? the. What Is Subject To Sales Tax In Tennessee.

From data1.skinnyms.com

Printable Sales Tax Chart What Is Subject To Sales Tax In Tennessee Sales tax in tennessee applies to most retail sales, as well as leasing or renting tangible personal property and selling certain taxable services, amusements, software, and digital products. do you need to collect and remit sales tax in tennessee? tennessee nexus requirements.22 1. which sales are subject to tennessee sales tax? the sales tax is tennessee’s. What Is Subject To Sales Tax In Tennessee.